Pay Calculation Tutorial – Overloads

Warning: This page is out of date and outlines a contractual process that is now changed! This page is being left in place, however, as it contains other useful resources and can be used to calculate retroactive payments. See Appendix B of our current CBA for updated information.

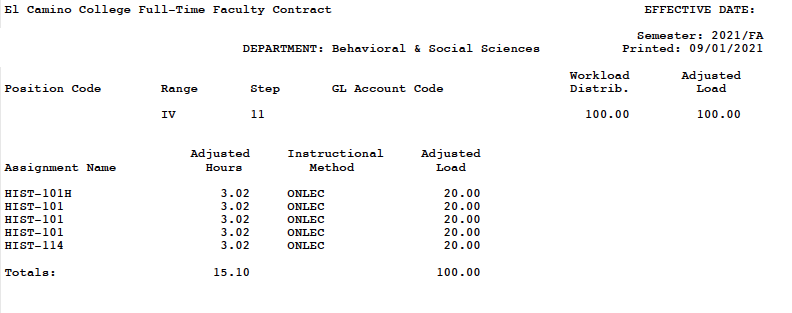

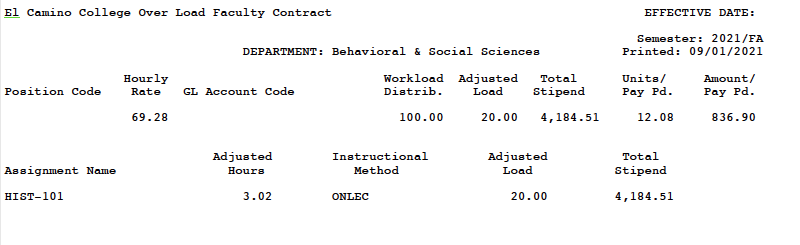

If your teaching load contains overload, as the examples on this page do, there should be a second page of your contract listed as an “Over Load Faculty Contract” (see below). You need both pages to calculate the load and check the pay amount listed on the overload contract. Overload pay errors are one of the most consistent problem areas in our contracts. For more explanation of the load calculation below, visit the parent page of this tutorial.

EXAMPLE #1

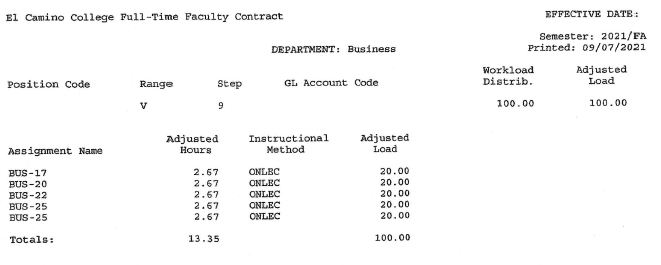

Regular contract:

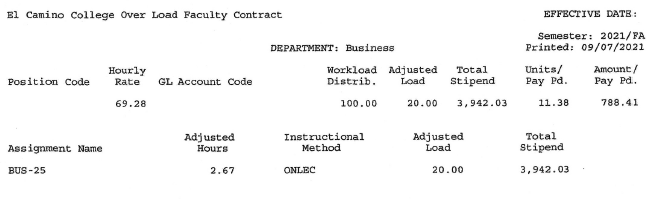

Overload contract:

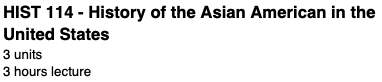

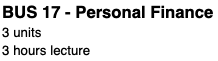

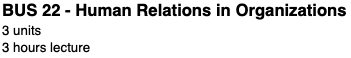

Course catalog entries:

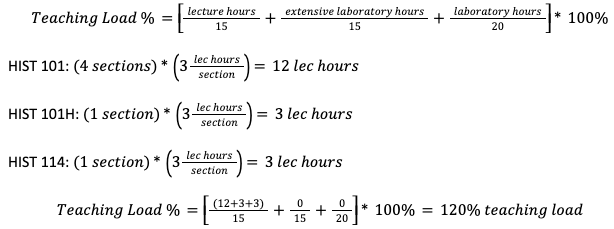

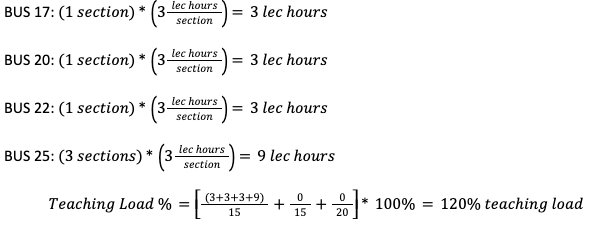

The 120% load calculation in this contract falls above 106.67%, so overload pay applies (Appendix B of collective bargaining agreement). To calculate the amount of overload pay, you’ll again need Appendix B. The formula that governs overload pay is somewhat obscure, but is as follows:

Where P = the overload percentage in excess of 100%

Where R = the pay rate in dollars per hour for overtime hours (Appendix D-3 Rate 1)

Where N = the total number of hours in the total teaching load calculation (the sum of the numerators in the teaching load equation above)

For this example,

R = $69.28 (as of December 1, 2021, this rate is $74.27)

N = 18 hours

P = 20%

Accordingly, monthly overload pay would be calculated as follows:

![]()

This number should be reflected in the “Amount/Pay Pd.” field in the upper right of the overload contract. As you can see from this example, this faculty member was slightly overpaid due to a systematic rounding error in the District’s Colleague software. Finally, the “Total Stipend” field is calculated by multiplying this monthly overload rate by 5. The reason for this is that you are paid for 5 of the 6 months during the fall/spring terms for overload, as you are not teaching your fall/spring courses in July/January.

EXAMPLE #2

In contract example #2, the instructor has the same percentage of overload (20%), but a likely human data entry error compounded the coding errors in the District’s Colleague software, leading to an underpayment. Calculations are shown below.

Regular contract:

Overload contract:

Course catalog entries:

As was the case for example #1, for this example,

R = $69.28 (as of December 2021, this rate is $74.27)

N = 18 hours

P = 20%

![]()

In this example, this faculty member would have been underpaid by $214.75 in overload pay if they had not caught this error.